Definition of Overtime under Japan’s Labor Standards Act

In Japan, what is commonly referred to as “overtime” is called zangyō (残業). This does not simply mean “working late,” but specifically refers to work performed in excess of the legally defined working hours.

Under the Labor Standards Act of Japan, the statutory working hours are set at 8 hours per day and 40 hours per week, and employers must also provide at least one day off per week (Articles 32 and 35 of the Act). Therefore, any work that exceeds these standards is classified as “overtime (残業)” or “work beyond statutory hours (時間外労働).”

In other words, only work beyond the statutory working hours is legally recognized as overtime. For example, suppose a company sets its own working hours at 7 hours per day. Even if an employee works one additional hour, this does not yet exceed the statutory 8-hour limit, and therefore is not legally considered “overtime.” It merely exceeds the company’s prescribed working hours, not the legal definition of overtime.

To summarize:

・Prescribed working hours (所定労働時間): The working hours defined in the employment contract with the company (e.g., 7 hours per day).

・Statutory working hours (法定労働時間): The working hours defined by law (8 hours per day, 40 hours per week).

・Statutory holidays (法定休日): Legally guaranteed rest days of at least one day per week.

・Overtime (残業): Work exceeding the statutory working hours.

Thus, it is important to distinguish between exceeding company-prescribed hours and legally defined overtime, while also remembering that workers must be guaranteed at least one day off per week.

Overtime Limits under Japan’s Labor Standards Act

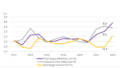

Under Japan’s Labor Standards Act, strict limits are placed on overtime work (残業, “work beyond statutory hours”). In principle, overtime cannot exceed 45 hours per month or 360 hours per year. These limits serve as the basic threshold to protect workers’ health, and exceeding them is generally prohibited.

However, during busy periods or under special circumstances, employers and employees may agree to exceed these limits. This is made possible through the so-called “special clause” (特別条項付き協定) included in a 36 Agreement (サブロク協定). Only when such a clause is signed and reported to the Labor Standards Inspection Office can overtime beyond 45 hours per month be temporarily permitted.

Even then, additional restrictions apply, meaning unlimited overtime is not allowed. These include:

・Annual overtime cap: within 720 hours

・Monthly overtime cap: less than 100 hours (including work on holidays)

・Two- to six-month average: 80 hours or less (including work on holidays)

In short, the general limits are 45 hours per month and 360 hours per year, and only under special agreements and circumstances can these be exceeded. This system was strengthened under the 2019 Work Style Reform Act (働き方改革関連法) to help prevent karoshi (過労死, death from overwork), a serious social issue in Japan.

[Reference material on the 36 Agreement from Japan’s Ministry of Health, Labour and Welfare]

Calculation of Overtime Pay and Premium Rates

●How to Calculate Overtime Pay

When employees work overtime, companies are legally required to pay an additional premium of at least 25% on top of the base wage. This is mandated by the Labor Standards Act as compensation for work beyond statutory hours.

Formula for calculation:

= Hourly wage × Number of overtime hours × Premium rate

Example:

If an employee with an hourly wage of 1,500 yen works 2 hours of overtime:

= 1,500 yen × 2 hours × 1.25 = 3,750 yen

Thus, the worker receives 3,750 yen in overtime pay in addition to the base wage.

●Premium Rates by Condition

In certain situations, higher premium rates apply:

・Night work (10 p.m.–5 a.m.): An additional 25% of the base wage.

If overtime occurs during night hours, both the overtime premium (25%) and the night premium (25%) are added, resulting in a 50% premium.

・Work on statutory holidays (at least one guaranteed day off per week): An additional 35% or more of the base wage.

If holiday work also overlaps with night hours, the premiums are combined, resulting in even higher pay.

・Overtime exceeding 60 hours per month: Since April 2023, this rule has also applied to small and medium-sized enterprises. For hours beyond 60, a 50% premium applies. If these hours also fall at night, an additional 25% is added, totaling a 75% premium.

●Legal Procedures and Restrictions

・36 Agreement (サブロク協定)

Simply paying a premium wage does not make overtime legal. Employers must conclude a written agreement (the “36 Agreement”) with employees and submit it to the Labor Standards Inspection Office in order to require overtime or holiday work.

・Protection of young workers

Workers under 18 years old are, in principle, prohibited from working overtime, on holidays, or at night.

The Reality of Japanese Companies as Experienced by a Foreigner

I am a Korean who has lived in Osaka and worked for about ten years, during which I experienced four different companies. Please note that my personal experiences cannot represent all Japanese companies, as they are purely individual and subjective. In addition, I have also referred to stories from people around me.

1. Is the overtime really necessary?

I believe that if overtime is truly necessary, it should be done. However, based on my experience working at a company where overtime was common, I sometimes wondered whether the overtime was really necessary. Was I staying late simply because of the company atmosphere? Was it work that truly needed to be finished now, or could it wait until tomorrow? Or was it the result of not fully focusing during regular working hours? I think the cause could lie with the company, but it could also lie with the individual.

2. Overtime for the allowance

Although it may be a minority, I have actually seen cases where people worked overtime just to earn the overtime allowance. Of course, it is a matter of personal freedom, and if the company permits it, it is not necessarily bad. Still, when considering the value of personal time as well as the company’s productivity and efficiency, I could not see it as entirely positive.

3. Was the assigned workload appropriate in the first place?

From the company’s perspective, it is natural to provide a salary and expect a reasonable amount of work in return. However, since each person’s abilities and aptitudes differ, it is also necessary to consider whether the workload assigned was actually achievable within the designated working hours.

Comments