Understanding the Healthcare System in Japan

Japan is well known for its high-quality yet relatively affordable healthcare system, but if you are visiting a hospital for the first time or are not accustomed to using it, the process can feel somewhat complicated. When I first went to a hospital in Japan, the only thing I knew was that I needed to bring my health insurance card (which has been integrated with the My Number card since December 2024).

However, by understanding Japan’s health insurance and medical cost system in advance, you can avoid unnecessary confusion and unexpected expenses. In this article, I will share my experiences as a foreigner and company employee living in Japan—covering information about medical costs, ways to save money on healthcare, and useful tips that may come in handy someday.

– Recommended Reading –

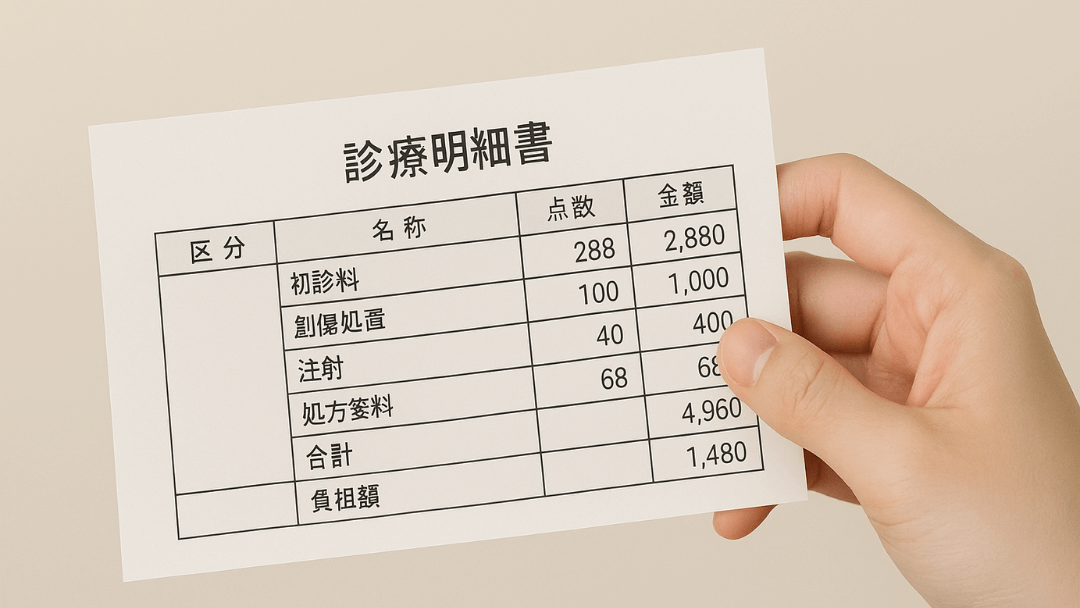

Understanding Medical Costs in Japan

1. You typically pay 30% of medical costs

All residents of Japan are required to join a health insurance system. For employees, health insurance is included in their monthly payroll deductions. Freelancers, students, and unemployed individuals are enrolled in the National Health Insurance plan and pay premiums directly.

In most cases, patients pay only 30% of the total medical cost.

Elderly people or those with low income may pay as little as 10–20%.

2. There’s a cap on monthly out-of-pocket expenses

Japan has a system called “Kōgaku Ryōyōhi Seido” (High-Cost Medical Expense Benefit), which refunds medical costs that exceed a monthly limit.

The cap varies depending on your age and income. You can apply for reimbursement if your out-of-pocket costs in a single month exceed the threshold.

For more detailed information on the High-Cost Medical Expense Benefit system, please click the link below. If you need a foreign language display, you can use the language selection menu at the top right of the website.

3. Scope of Health Insurance Coverage

In Japan, health insurance broadly covers most standard medical treatments, including hospitalization, surgery, and prescription medications. This means that even in cases of sudden illness or injury, you can receive essential medical care at a relatively low cost thanks to insurance coverage.

However, treatments for cosmetic purposes or elective procedures are often not covered by insurance. For example, plastic surgery, teeth whitening, and certain advanced medical examinations that use the latest equipment must usually be paid for entirely out of pocket. Therefore, it is advisable to check in advance whether a treatment or test is covered by insurance before receiving it.

4. Payment Methods at Hospitals

In most hospitals in Japan, you can conveniently pay medical fees using credit cards, transportation IC cards, or mobile payment apps. More and more hospitals are also introducing QR code payments and electronic money, making it increasingly easy to settle bills without cash.

However, there are still some hospitals and small clinics that only accept cash. This is particularly common in rural areas or smaller private practices. Therefore, it is a good idea to check the hospital’s website in advance or call directly to confirm which payment methods are available before your visit.

Tips for Managing Medical Costs in Japan

1. Check if You Are Eligible for a Reduced Copayment Rate

In Japan, patients usually pay 30% of medical costs, but low-income households, students, and the elderly may qualify for a reduced rate of 10–20%. Since the criteria vary by municipality, it is best to confirm with your local city or ward office. This can be especially helpful if you need long-term treatment or hospitalization.

2. Request Generic Medicines

At pharmacies in Japan, you can save money by asking for generic (equivalent) medicines. These contain the same active ingredients and have the same effect as branded drugs but are usually less expensive, which is especially helpful if you need long-term medication.

Simply tell the pharmacist, “ジェネリックでお願いします (Jenerikku de onegaishimasu)”, which means “I’d like the generic version, please.”

3.Use Local Clinics for Mild Symptoms

For minor symptoms such as colds, light fevers, or small injuries, it is often cheaper and faster to visit a local clinic rather than a large hospital. Clinics usually have shorter waiting times and are more convenient, making them ideal for everyday medical needs.

4. Enroll in National Health Insurance After Leaving a Job

If you leave your job and there is a gap of more than one month before starting a new one, you must apply for National Health Insurance (Kokumin Kenkō Hoken) at your local city or ward office. Without enrolling, you will be required to pay the full amount of medical expenses out of pocket. However, if you are starting a new job the following month, you generally do not need to enroll separately.

In addition, if you remain unenrolled in the National Health Insurance after leaving your job and only decide to join a few months later when you need to visit a hospital, you will be required to pay back premiums for the entire uninsured period in a lump sum. Knowing this in advance can help you avoid unexpected costs.

If you remain unemployed for several months, you may also be eligible for a reduction in insurance premiums, so it is worth consulting your local city office.

Comments